ANALISIS PERBANDINGAN TRADING VOLUME ACTIVITY, ABNORMAL RETURN SAHAM DAN BID ASK SPREAD SEBELUM DAN SESUDAH STOCK SPLIT

Abstract

Full Text:

PDFReferences

Adliah, Shabrina Nur. 2017. Analisis Abnormal Return dan Trading Volume Activity Sebelum dan sesudah Stock Split : Studi pada Perusahaan Go Public Periode 2014-2016. Jurnal Ilmu Administrasi dan Bisnis. (Volume 49 No. 1).

Alexander dan Kadafi, M. Amin. 2018. Analisis abnormal return dan trading volume activity sebelum dan sesudah stock split pada perusahaan yang terdaftar di BEI.

Anwar, Fahrizal dan Nadia Asandimitra. 2014. Analisis Perbandingan Abnormal Return, Trading Volume Activity, dan Bid-Ask Spread Sebelum dan Sesudah Stock Split. Jurnal Bisnis dan Manajemen. Vol. 7(1)

Asriningsih, Wening. 2015. Analisis Abnormal Return dan Likuiditas Saham Sebelum dan Sesudah Stock Split Periode 2018-2012. Jurnal Economia Universitas Negeri Yogyakarta (Volume 11 No. 1).

Copeland, Thomas E. 1979. Liquidity Change Following Stock Splits. Journal of Finance, Vol. XXXIV, No.1 (march), p.115-141.

Fama, E. F., Fisher, L., Jensen M. C., & Roll, R., 1969, “The Adjustment of Stock Prices to New Informationâ€, International Economic Review, Vol. 10, pp. 1- 21.

Griffin, Carroll Howard. 2010. Abnormal Returns and Stock Splits: The Decimalized vs Fractional System of Stock Price Quotes. International Journal of Business and Management, 5(12), pp:3-13.

Hadiwijaya, Cindy,.&Widjaja, Indra. 2018. Analisis perbandingan abnormal return dan likuiditas saham sebelum dan sesudah stock split pada perusahaan yang terdaftar di BEI periode 2010-2015.

Hartono, Jogiyanto. 2000. Teori Portofolio dan Analisis Investasi. Edisi Ketiga. Yogyakarta:BPFE. Hartono, Jogiyanto. 2010. Teori Portofolio dan Analisis Investasi. Edisi Ketujuh. Yogyakarta: BPFE. Hartono, Jogiyanto. 2013. Teori dan Analisis Investasi. Edisi Kedelapan.Yogyakarta : BPFE. Hartono, Jogiyanto. 2014 Teori dan Analisis Investasi. Edisi Kesembilan. Yogyakarta: BPFE.

Pramana, Andi. 2012. “Analisis Perbandingan Trading Volume Activity dan Abnormal Return Saham Sebelum dan Sesudah Pemecahan Saham (Studi Kasus Pada Perusahaan Yang Terdaftar di Bursa Efek Inonesia Periode 2007-2011)â€. Diponegoro Journal Management.

Priyatno, Duwi. 2014. SPSS 22 Pengolah Data Terpraktis. Yogyakarta: Andi Offset

Sugiyono. 2010. Metode Penelitian Bisnis Pendekatan Kuantitatif, Kualitatif dan R&D. Bandung: Alfabeta.

Weston, J. Fred & Eugence F. Brigham, Modern Portfolio, 11 edition, 1996, The Dryden Pass, New York.

Widiatmoko, Paramita (2017). Analisis perbedaan return saham, Trading Volume Activity dan Bid Ask Spread sebelum dan sesudah Stock Split (studi kasus pada perusahaan yang terdaftar di Bursa Efek Indonesia tahun 2010-2014. Jurnal Manajemen [vol 14 no.1, Mei 2017 :17-32]

DOI: https://doi.org/10.56486/kompleksitas.vol10no01.84

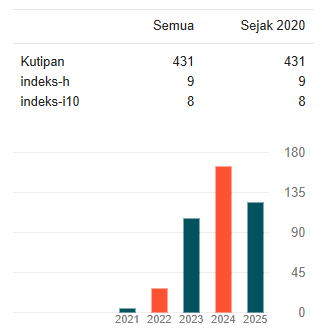

Article Metrics

Abstract view : 2085 timesPDF - 1527 times

Refbacks

- There are currently no refbacks.

TERINDEKS OLEH :